The latest filings for Boxxer Limited have revealed a noticeable downturn in the promotional outfit’s financial position, with 2023-2024 submitted accounts showing a steep slide from modest stability to losses.

Boxxer Limited Sees £2.74 Million Swing Into the Red

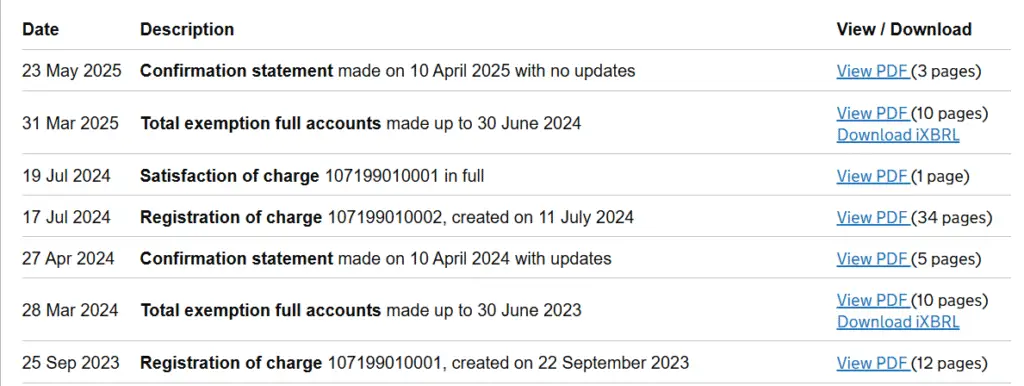

According to the new data from Companies House, Boxxer Limited reported a sharp fall when comparing to previous submissions in net assets from a positive £1.02 million in 2023 to a negative £1.72 million in the financial year of 2023/24. The near £2.74 million swing is largely tied to a major hit to retained earnings, which dropped from £(179k) to £(2.92 million).

Liquidity and Debt Warning Signs

Beyond the profit and loss picture, Boxxer’s liquidity also deteriorated:

- Cash reserves fell from £2.55 million to £1.82 million.

- Short-term creditors rose from £2.76 million to £3.2 million.

- Net current assets dropped from a £1 million surplus to a £666k deficit.

In addition, long-term debt surged from £114k to £1.1 million an increase of nearly £1 million in non-current borrowings, indicating the business likely had to rely on external funding to plug operational gaps.

In Boxxer Limited’ Own Words – Dependent on Creditors

Perhaps the most concerning part of the filing is the going concern statement. Boxxer notes that its future viability depends on “the ongoing support of its creditors.” This cautious phrasing hints at underlying uncertainty, suggesting the company may need favourable terms from suppliers and lenders to stay afloat.

Tangible Assets Contract

Boxxer’s tangible asset base also shrank, down from £93k to just £55k a modest but symbolic sign of a company in contraction.

From mounting short-term liabilities to rising long-term debt and deteriorating liquidity, Boxxer Limited’s 2023/24 financial snapshot paints a picture of a company under pressure. While the business continues to operate and still promotes major events its accounts show that survival may hinge not just on future growth, but on the continued goodwill of those it owes.

Disclaimer:

This article is based solely on information that is publicly available via Companies House in the United Kingdom. NoSmokeBoxing.com has reported these details in good faith and does not accept responsibility for the accuracy of the data as filed by Boxxer Limited or published by Companies House. Any interpretations or summaries reflect the figures as disclosed in the unaudited financial statements.